Pizza Hut – How Lock-in Causes Growth Stalls, Irrelevancy and Bad Results

We see it all too often. A successful business seems to lose its way. Somehow, after decades of success, its results soften, then tumble and the company becomes a victim of its competition. We scratch our heads and wonder, “why did that happen?”

Pizza Hut is well on its way to disappearing. Kind of like Pizza Inn, A&W and Howard Johnson’s. And that seems kind of remarkable considering the company at one time defined pizza for most Americans. From a fast growing franchise in the 1960s to a high profile acquisition by PepsiCo in the 1970s, to anchoring the Yum Brands spin out from PepsiCo in 1997, Pizza Hut just finished 8 straight quarters of declining same store sales. Pizza Hut was once a concept as hot as Apple Stores, but now it looks more like Sears. How could this happen?

When Pizza Hut was growing it locked in on its success formula. And one of the biggest Lock-ins was its name. Pizza Hut was a place where you ate pizza, and the buildings all looked the same with that hut-like red roof. At a time when few Americans outside the northeast ate pizza, this Wichita, Kansas founded (and headquartered until the 1990s) company told people what a pizzeria should look like, and what you should eat.

The company was ardent about controlling what franchisees served. No nachos, or other trendy foods, because they didn’t fit the pizza theme. No delivery, because good pizza required you eat it immediately from the oven. Pizza should be thick and hearty, even served in a deep dish so you have plenty of bread and feel really full. Whether anyone in Italy ever a pizza anything like this really did not matter.

And Pizza Hut would help guide customers as to what toppings they wanted — and usually there should be at least 3 – by offering pre-designed pizzas with names like “meat lovers,” “supreme,” “super supreme” or “veggie lover’s” so an uninformed clientele (originally prairie state, then midwestern, then expanding into the southwest and the south) could buy the product without a lot of fuss.

This success formula may sound cliche today, but it worked. And it worked really well for 30 years, then pretty well for another 10-15. But, eventually, doing the same thing over, and over, and over, and over had less appeal. Almost everyone in the country knew what a Pizza Hut was, what the stores looked like and what the product was like. Competitors came along by the dozens with all kinds of variations, and different kinds of service – like being in a mall, or delivering the product. Inevitably this competition led to price wars. To keep customers Pizza Hut had to lower its prices, even offering 2 pizzas for the price of one. Pizza Hut never lost track of its success formula, and never stopped doing what once made it great. But margins eroded, and then sales started declining.

Lots of people don’t care about Pizza Hut any more. They want an alternative. An alternative product, like California Pizza Kitchen or Wolfgang Pucks. Or an alternative to pizza altogether like the new “fast casual” chains such as Chipotle’s, Baja Fresh or Panera. For a whole raft of reasons, people decided that although they once ate Pizza Hut (even ate a LOT of it) they were going to eat something else.

But Pizza Hut was locked in. First, its name. Pizza. Hut. To fulfill the “brand promise” of that name everything about that store is pre-designed. From the outside to the inside tables to the equipment in the kitchen. 6,300 stores that are almost identical. Any change and you have to make 6,300 changes. Adding new product categories means reprinting 126,000 menus, changing 6,300 kitchen layouts, buying 6,300 new ovens, figuring out the service utensils for 6,300 wait staff. That’s lock-in. Making any change is so hard that the incentive is entirely toward improve what you’ve always done rather than doing something new.

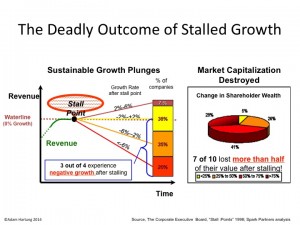

Growth Stalls are Deadly

Eventually, like Pizza Hut, growth stalls. It only takes 2 quarters of declining sales to hit a growth stall, and when that happens less than 7% of businesses will ever again consistently grow at a meager 2%. Growth stalls tell us “hey, the market shifted. What you’re doing isn’t selling any more.”

But most management teams don’t think about a market shift, and instead react by trying to do more of the same. They treat this like its an operational problem. More quality campaigns, more money spent on advertising, more promotions, asking employees to work a little harder, more product for the same (or lower) price – more, better, faster, cheaper. But this doesn’t work, because the problem lies in a market shift away from your “core” that requires an entirely different strategy.

Because management is incented to ignore this shift as long as possible, the company soon becomes irrelevant. Customers know they’ve been going to competitors, and they start to realize it’s been a long time since they bought from that old supplier. They realize their interest in that old company and its products has simply gone away. They don’t pay attention to the ads. And they don’t have any interest in new product announcements. Actually, they find the company irrelevant. Even when the discounts are big, they don’t buy. They do business where they identify with the company and its products, even when those products cost more.

And thus the results start to tumble horribly. Only by now management is so far removed from market trends that it has no idea how to regain relevancy. In Pizza Hut’s case, leadership is undertaking what they’d like to think is a brand overhaul that will change its position in customers’ minds. But, unfortunately, they are doing the ultimate in defend & extend management to try and save the old success formula.

Pizza Hut is introducing a maze of new ways to have its old product, in its old stores. 10 crust choices, 6 sauce choices, 22 of those pre-designed pizza offerings, 5 different liquids you can have dribbled over the pizza, and a rash of exotic new toppings – like banana. So now you can order your pizza 1,000 different ways (actually, more like 10,000.) Oh, and this is being launched with a big increase in traditional advertising. In other words, an insane implementation of what the company has always done; giving customers an American style pizza, in a hut, promoted on TV – even most likely buying what is now considered iconic – a Super Bowl ad.

Yum Brands investors have reasons to be concerned. Pizza Hut is really important to sales and earnings. But its leaders are intent on doing more of the same, even though the market has already shifted. The prognosis does not look good.